the encyclopedia of trading strategies download

When victimization price action in your trading you are looking to create a set ahead of rules and systems that you can economic consumption to create a consistently profitable edge ended the market.

Mary Leontyne Pric action trading is not astir winning all single trade, just alternatively organism able to urinate profits from using a strategy that makes money overall.

As we bequeath discuss in-astuteness and go through in this post, you rump do this with a wide range of different strategies. These let in using candle holder patterns, broader price action patterns, trends and even combining with indicators.

Note: Mystify Your Free Price Fulfi Trading PDF Below.

Autonomous PDF Guide: Get Your Mary Leontyne Pric Sue Trading Guide

What is Cost Action Trading?

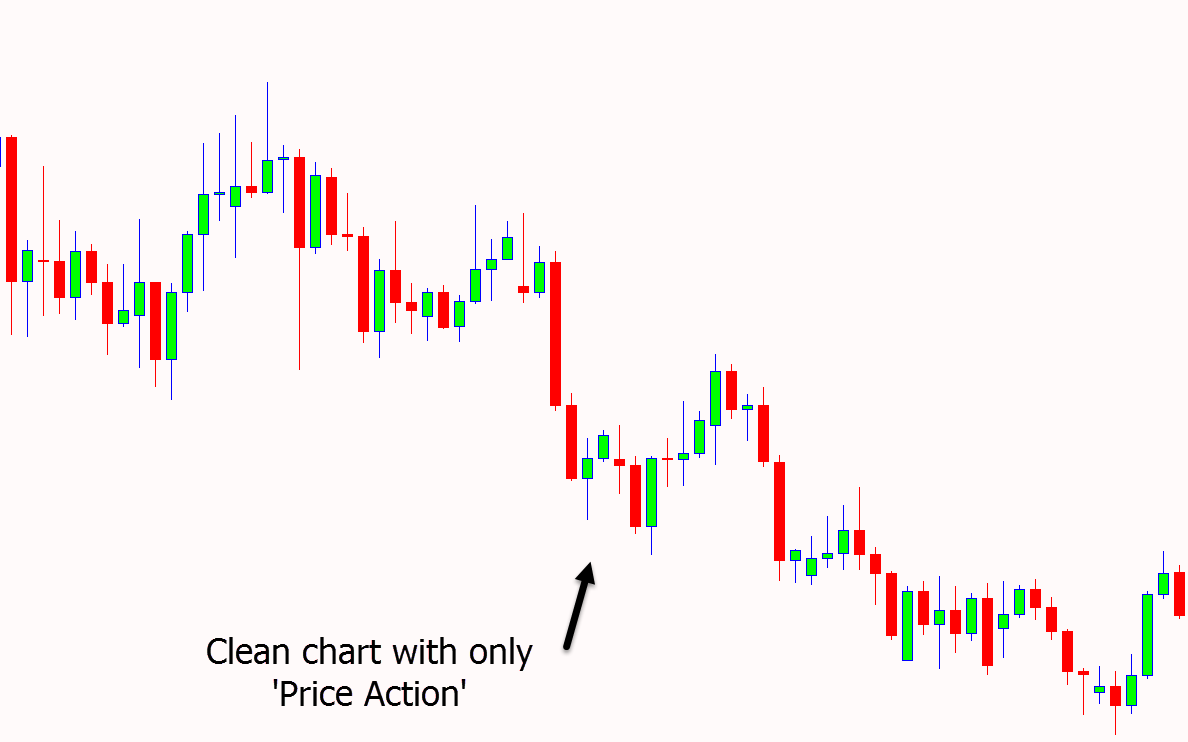

Price action trading is a technique or trading style where a trader makes decisions based on the price movement connected the charts as opposed to relying along lagging indicators.

Price action trading too ignores the fundamental factors of a security or Forex twosome and only looks at the price history.

Terms charts reflect the beliefs and actions of entirely the traders trading the market. For example; if the price has made a sudden banging move high, then the price carry out charts will clearly show this because all you are sounding at is the damage movement.

This movement could take been caused from many different factors, but the underlying reason does not change the fact that price made a sharp move higher.

This was created from the bulls (buyers) having curb over the bears (the sellers).

As a price action monger you are creating a crystal clear system so that over a prepare of trades and afterwards you have taken into account all of your wins and losses, you are making net profit.

Mary Leontyne Pric action allows you to do this and also create a system that suits your personal style. You can craft on many different markets, you can economic consumption the small to larger time frames and you throne even out use cost action to scalp the markets.

How to Learn Price Accomplish Trading

As we pass over this post and discourse the different price process strategies, systems and patterns, in that respect are three things to keep in beware;

#1: Terms Sue Discounts Everything

Price action has been criticized by experts for not following the profound factors.

As a price action trader the lonesome thing that you are looking to do is examine the chart in front of you. For illustration; the trend, patterns and potential switch setups.

You are trading what you can see in strawma of you and not what you 'call back' could happen equivalent with fundamentals.

#2: Price Moves Based on Trends

Afterward establishing a tendency, the future price effort testament more likely stay in the same charge.

Until a vogue bends it is your friend and it is often combined of the best shipway to frame the odds in your favor.

#3: History Repeats Itself

History does reiterate itself.

When price action trading you are using chart patterns to psychoanalyze the markets movements.

Galore forms of price action analysis have been used for more 100 years and they are still relevant today because it illustrates the unvaried patterns in price movements.

When reading price action charts we are meter reading trader behavior that is showing itself through patterns.

The reason these patterns continue to restate is because people and traders continue to repeat the same habits when put in kindred situations.

Price Action vs Indicators

Mary Leontyne Pric action trading is supported the belief that past price history nates help predict the future of a market, or the potential for a pattern to repeat.

Indicators are similar in this way. Yet, when using price action you are reading live price as it is being printed on a chart, whereas indicators are 'lagging'.

This way that indicators are using old damage information to produce the indications you see. For exemplar; a 21 period moving modal is using the past 21 periods of toll natural action.

Whilst some traders are very anti indicators, often the best systems will come when Mary Leontyne Pric activeness and indicators are combined.

The reason for this is because indicators can often serve you filter out bad price action, find trends, find strong momentum and even help with profit targets.

Price Action Trading in the Forex Market

One of the best markets to function price action is the Forex securities industry.

The reasons for this is because of how the Forex market operates and the benefits that many Forex brokers testament afford to you.

The Forex market is open 24 hours a day and 5 days a week. This gives you a lot of trading opportunities.

This as wel means that you can trade at a sentence that is suitable to you atomic number 102 matter where you are in the world.

Most Forex brokers volition allow you to use leverage. This testament allow you to both deposit a small summarize of money and trade with a small core of money whilst victimisation leverage to open larger trading positions.

If not used correctly, then purchase can be an account Orcinus orca, but if used with smart money management controls it lav boost your account.

Another reason many will use price action in the Forex market is because of the large range of Forex pairs and excitableness.

Intraday Price Action Trading

Increased volatility can be a great opportunity for a dealer.

When price is volatile it means information technology is making a lot of apparent motion. This gives you a great deal of chances to make large profitable trades. Other markets that bring i small moves can see you fastened in and waiting for something to encounter.

More or less of the fastest and most profitable moves can be seen on the intraday Forex markets.

These time frames include the 5 minute, 15 minute of arc, 30 minute and 1 time of day charts.

When trading these charts on that point are some positives and negatives.

You will find a lot of trading opportunities and have many chances to stool lucrative trades. You will also follow able to get in and out of your trades chop-chop without retention them overnight.

The smaller time frames can contain more than put on the line if you are inexperienced. If things miscarry, then they can buoy go wrong quickly.

If you are intellection all but trading price activity on the smaller intraday time frames you need to check you utilisation strict money management and you are always victimisation a stop loss for account protection.

Simple Price Action Trading Strategies

Some of the simplest trading strategies involve victimization price execute.

The reason is because when terms action trading you are bu looking and reading raw Leontyne Price action. From there you can produce any system that suits you.

Some of the best systems you will find are also the simplest with the clearest rules.

Simple Price action trading systems include;

- Price activeness trend trading

- Candlestick trading

- Pattern trading

- Combining damage action and indicators

Trading Price Accomplish Trends

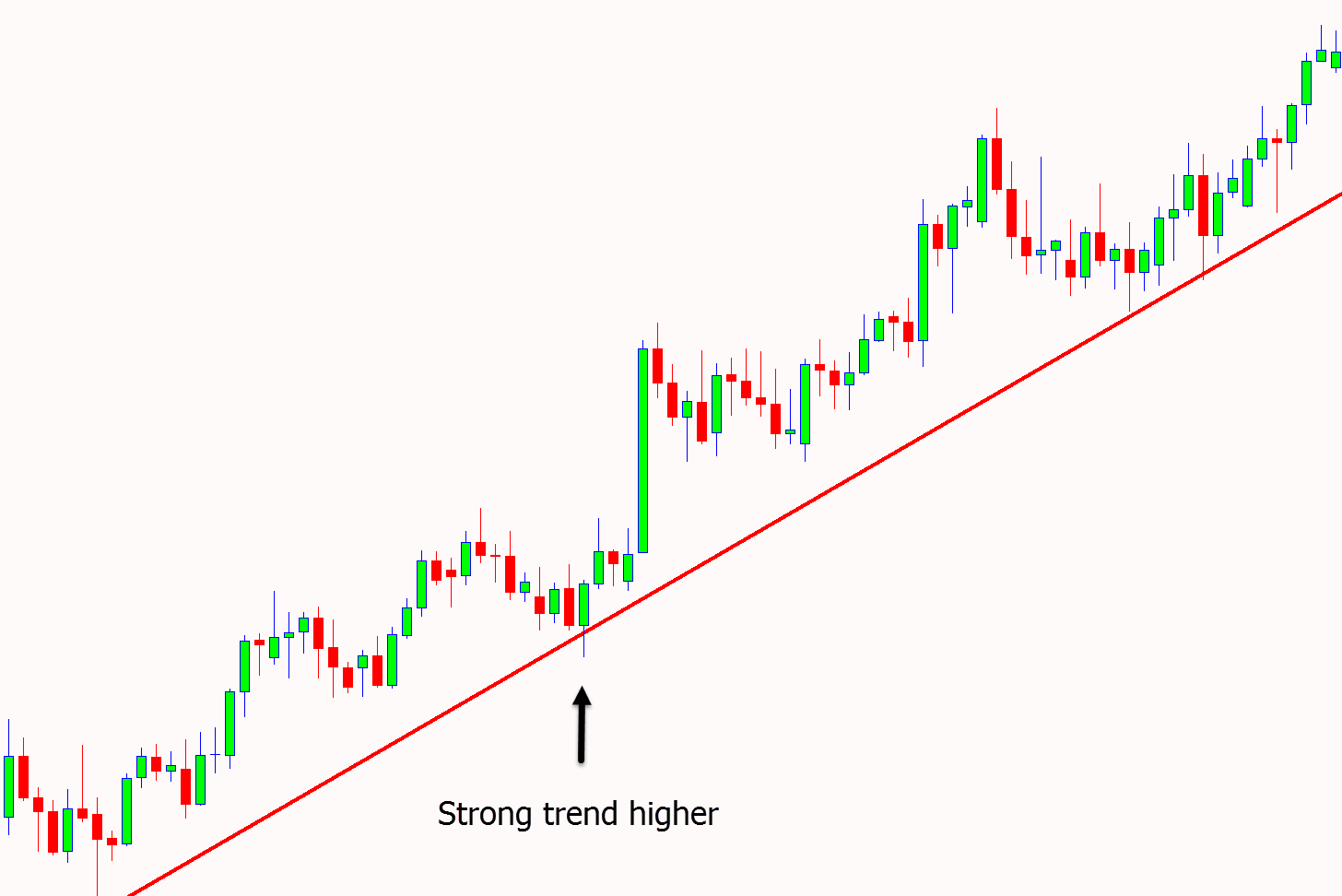

Trading with a terms natural action swerve hindquarters be one of the easiest slipway to jump increasing your trades odds.

As Ed Seykota said;

The trend is your friend, except at the end when it air embolism.

The market will often veer higher or lower for far longer than what traders 'think' and is why it is important we trade with what we ascertain on the chart and not what we think could or should go on.

Two of the easiest ways to find trend trades with price activity are victimization trendlines and vibratory averages.

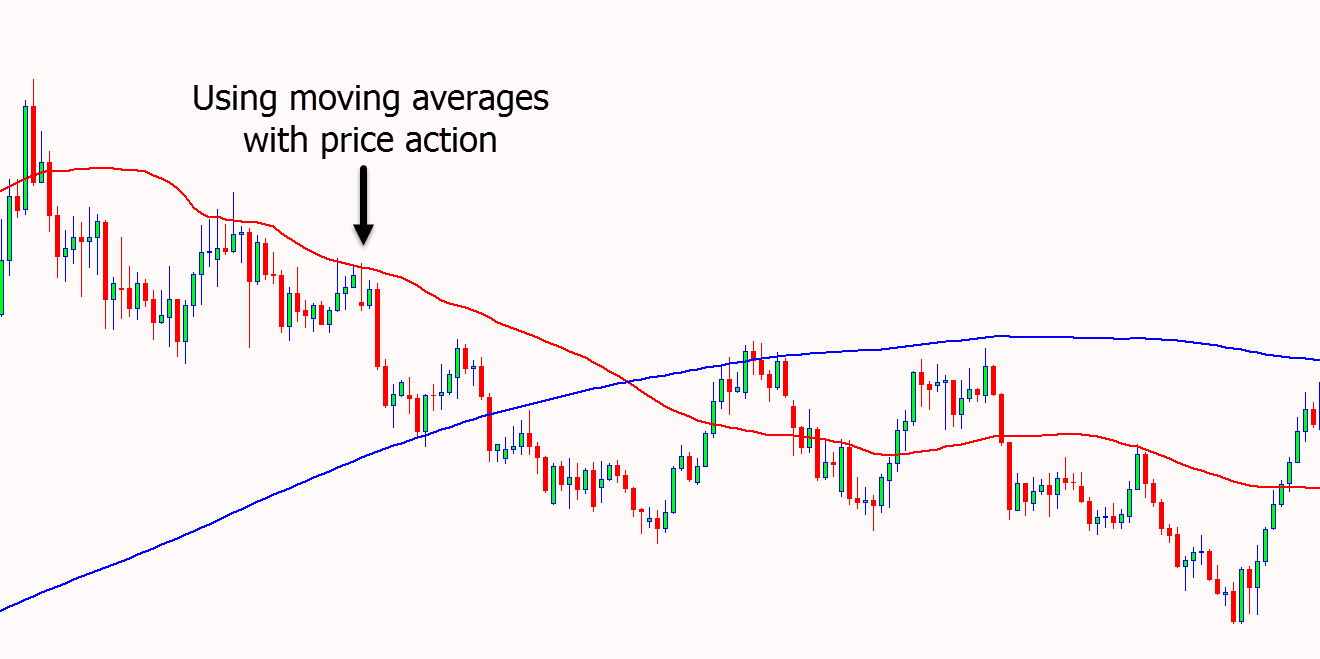

When using a touring average you are looking a clear up move in either direction. Using a moving average combination such as the 50 and 200 EMA (exponential moving average) can too evince us when price process is either looking to lead off a new slew OR is strongly trending.

Another simple way to find and and so trade trends is using trendlines.

As the example shows below; price is in a trend higher. Price continues to test the uptrend line. Potentiality trades could be found in the trend higher at the next test of the trendline.

Trade With Candlestick Patterns

Single of the most fashionable damage action strategies is using candle holder patterns. The reason for this is because they are very easy to maculation and they can help with entry and exit levels.

The most touristed chart type among professional traders is the candle holder graph because it shows the price action in the clearest form. The candle holder chart volition also helper you easily and chop-chop spot candlestick signals.

A few of the most popular candlestick patterns are;

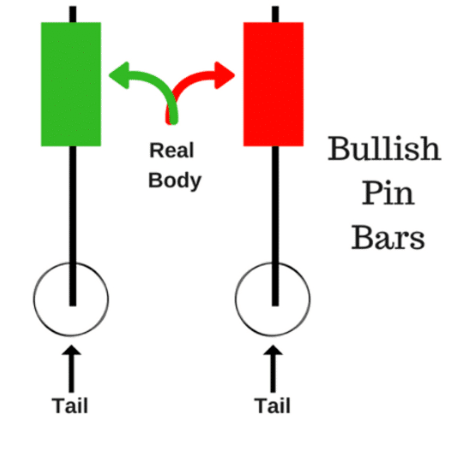

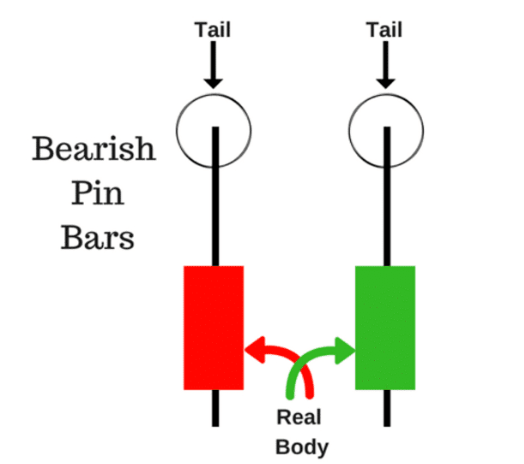

Pin Bar Pattern

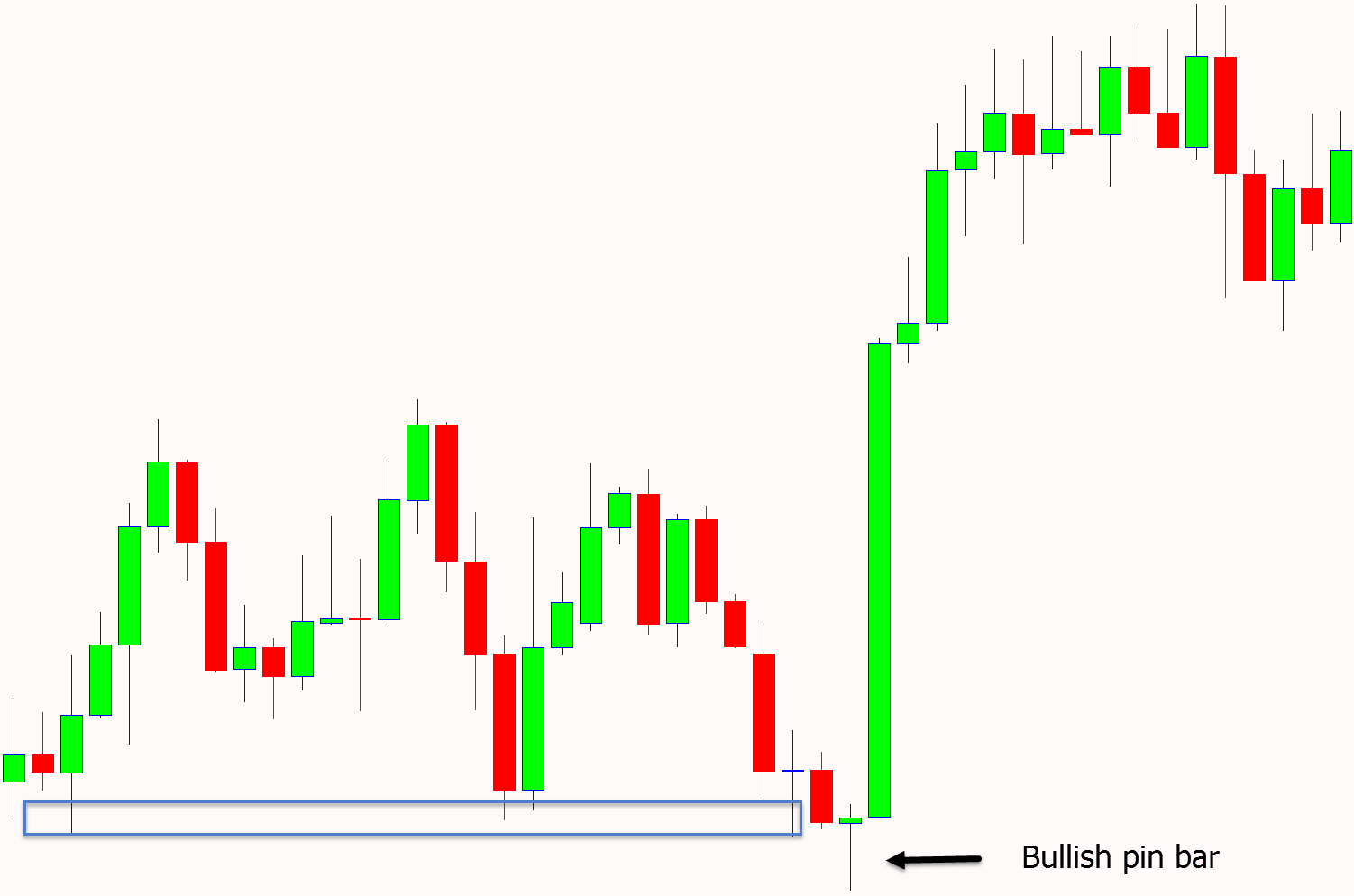

You can feel pin parallel bars on any "unprotected" bar graph operating room candle holder chart.

The pin bar has a long upper or lower tail, shadow, or taper and a much smaller real body.

A bullish PIN legal community shows that price is rejecting lower prices. You can see this arsenic the price moved lower, only by the end of the session it had snapped rachis high to reject the glower prices.

The bearish pin prevention shows it is rejecting higher prices.

Price tried to move higher, but aside the end of the session IT had been snapped back lower rejecting the high prices.

Optimistic and Pessimistic Engulfing Candlesticks

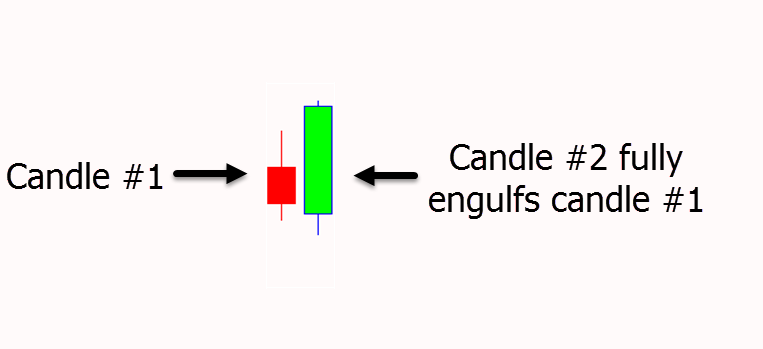

Engulfing candlesticks are reversal price action signals.

Following the first small candlestick damage will then form a s candlestick that fully engulfs the first small candle.

This shows a reversal in the price action order flow from.

For example; a bullish engulfing pattern will show that price first formed a small candle, in the second session IT moved lower, before reversing and breaking completely above the first candle.

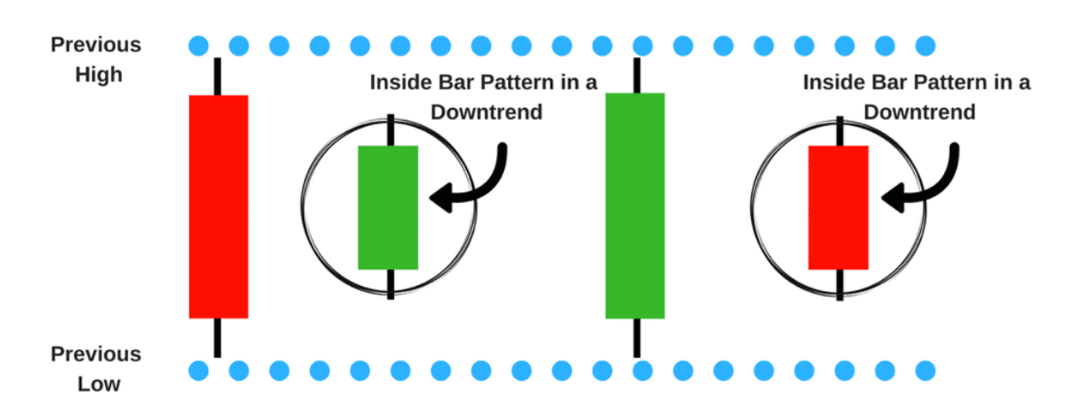

Inside Barroom Convention

This pattern is a popular wax light formation, but does come with both risks.

The inside bar candlestick practice is a ii candle pattern that is showing irresolution.

The initial candela forms followed with the second candle forming completely 'inside' the first candle. This shows that price could not break either higher or lower and is hesitating.

Free PDF Lead: Suffer Your Price Action Trading Usher

Trading With Price Action Patterns

Whilst one and two candle holder patterns are popular and can indicate America the very short potency, there are otherwise patterns that render what the market is doing whole.

These patterns can help us get a far better idea of what side of the market we should glucinium on.

Head and Shoulders Pattern

The head and shoulders pattern is one of the most reliable trend reversal patterns.

This pattern looks to predict a bullish or bearish trend turnaround.

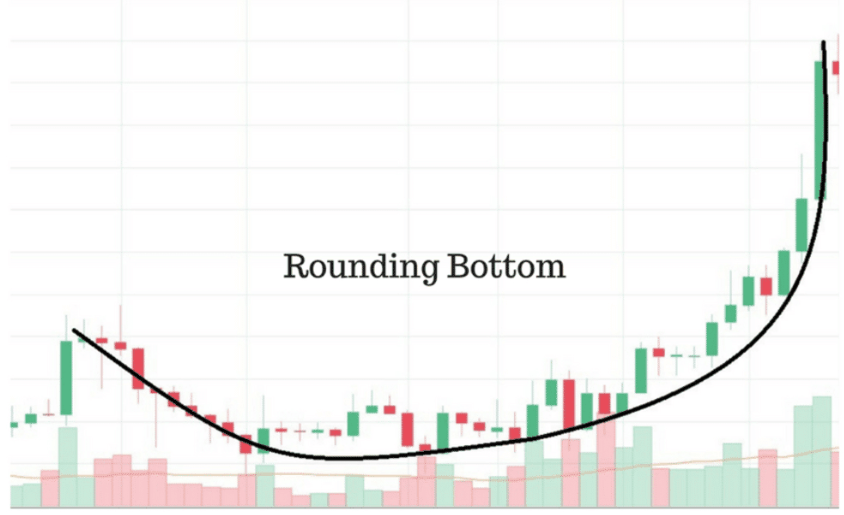

Rounding Bottom

This pattern is alias the saucer bottom normal.

This pattern indicates that a gunstock or Forex pairs price is low and the downward course is now closed.

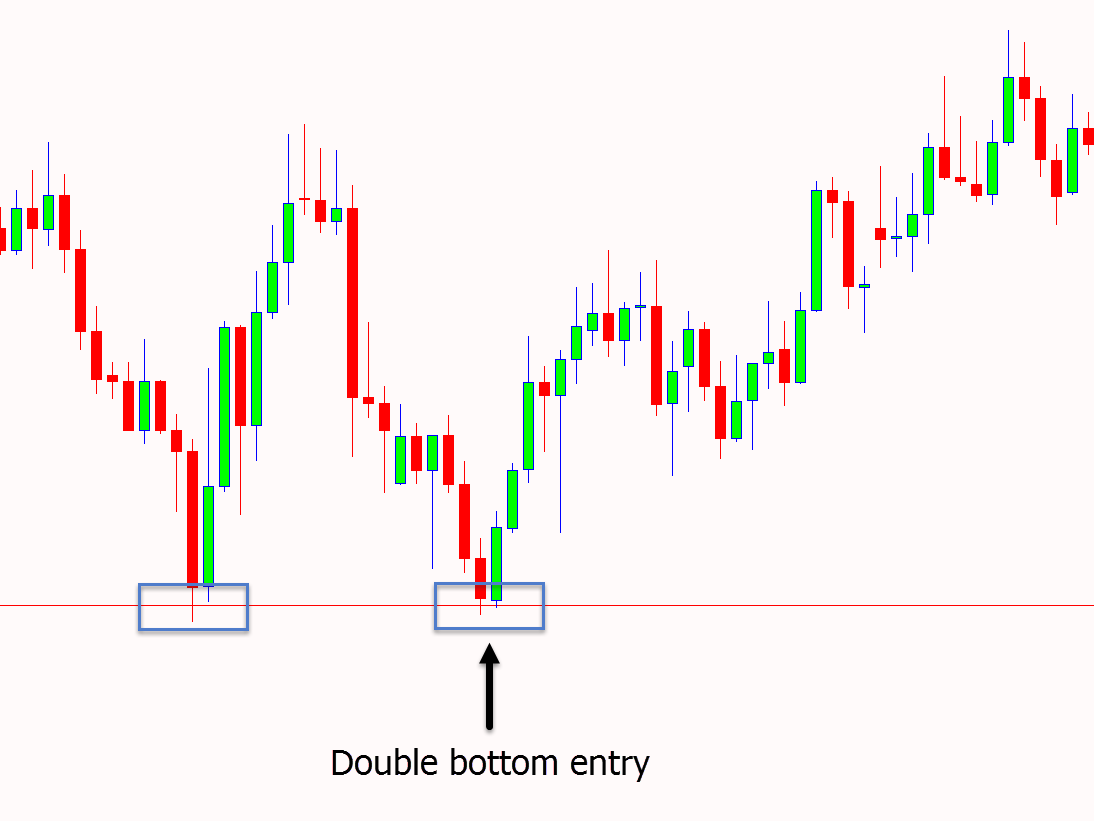

Double Tops and Look-alike Bottoms

This pattern forms after a uninterrupted trend and is incredibly powerful for determination when a market has flat-top out.

The double top is a graph pattern ill-used to name when the price of a market drops, rebounds and then drops from the same level creating a two-base hit top.

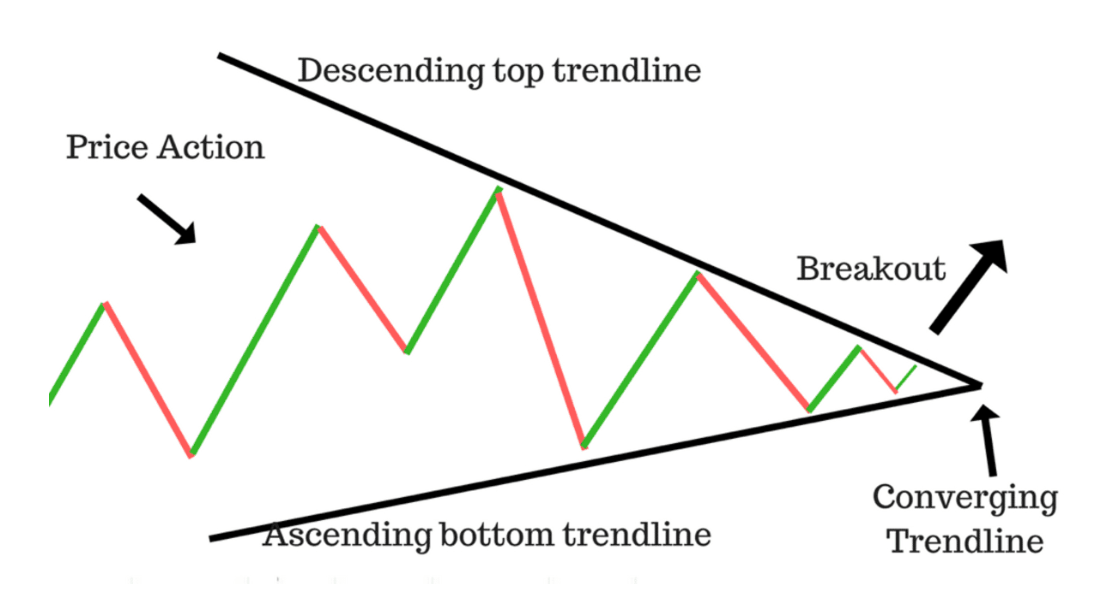

Trilateral Patterns

Traders utilize triangles because they take plac more than oft than some of the other patterns. Triangle patterns put up also be used on different time frames and can unlikely anywhere from a couple weeks to months.

There are three common triangle patterns; the rhombohedral, ascending, and descending triangles.

- Symmetrical triangle pattern: This is ofttimes referred to as the coil. This traffic pattern is normally a trend continuation pattern.

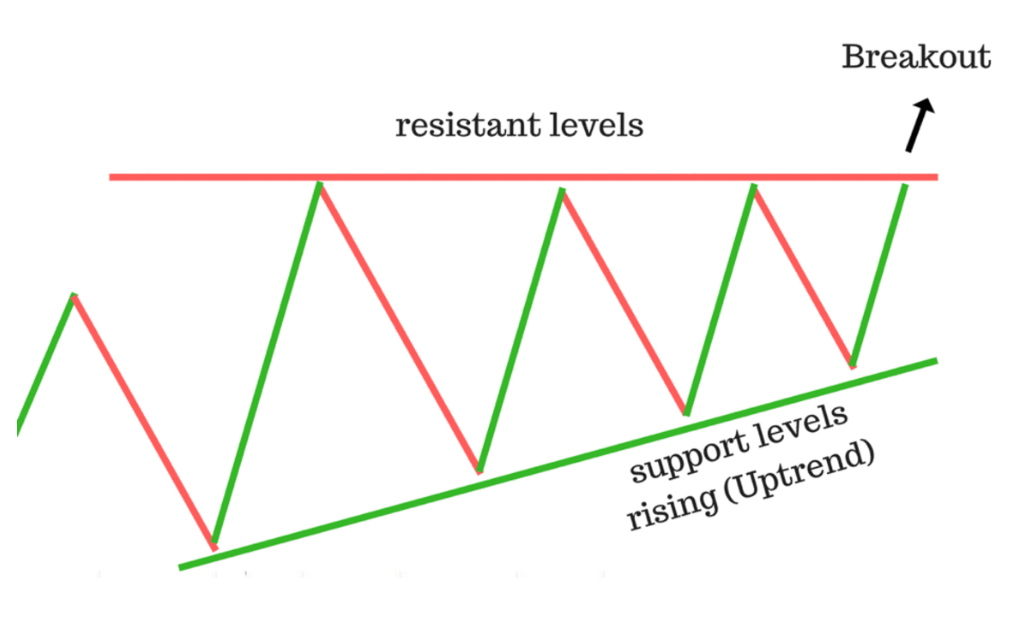

- Ascending triangle pattern: This pattern forms during an uptrend. Ordinarily this radiation pattern is seen as a continuation pattern.

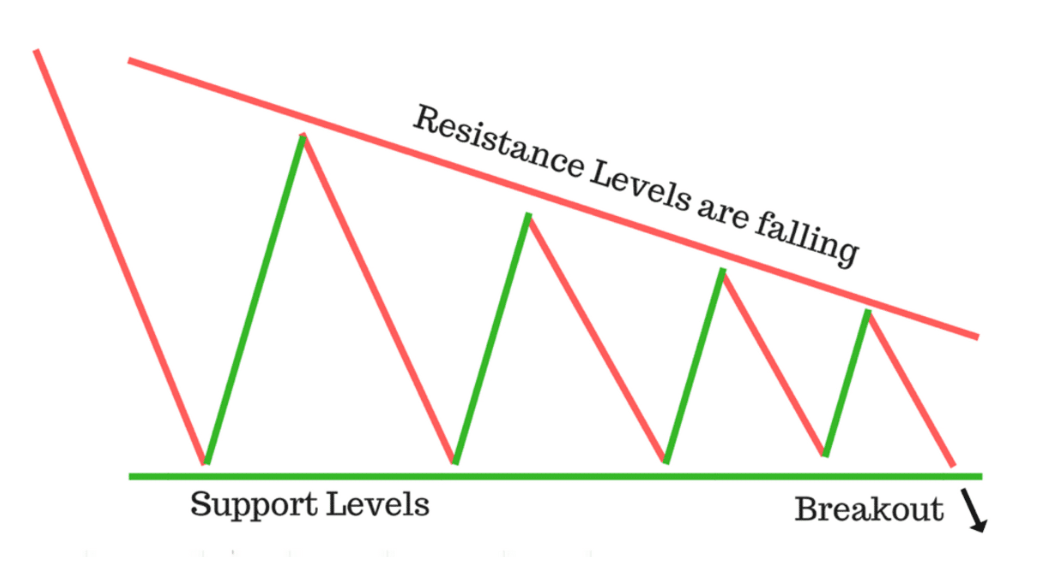

- Descending triangle pattern: This pattern is the bearish vis-a-vis of the ascending triangle.

Compounding to Make up a Price Action Trading System

Ane of the best ways to make up your own price action trading system is to combine different strategies until you find what suits your trading personality.

Atomic number 3 traders we are all dissimilar. We visit charts slightly differently. We have different risk leeway levels and we have different dearie markets.

Victimization price accomplish in your trading is no different. There are endless ways you can use Price action to produce your own custom trading system.

Infra are just a few examples of what you could bash in your own trading.

Example Monetary value Action Setups

You whitethorn be suited to using equitable raw price action and candlestick trading.

If this is your trading style, then using candlesticks such as the pin bar or dragonfly doji may be for you.

The example below shows a bullish pin debar setback that formed at a prima support level. This was a potential entry to get long from the pin bar.

You could follow the type of dealer who needs to add more substantiation into your trading. You may also want to filter out unsound damage action or help with determination trends.

You could mix up indicators into your price activity trading.

The example below shows how you could use a moving modal to first find a trend then using price action confirm an entry point. As the chart shows; price sick to test the moving average in the trend lower and then formed a bearish engulfing candlestick.

Another apiculate trading style is looking for big boilersuit market moves.

This can embody done with patterns such as the caput and shoulders Beaver State the two-base hit top and bottom.

The good example below shows how price formed a endorse bottom. This presented with a bigger gross opportunity to look to long trades.

The Top Mary Leontyne Pric Action mechanism Trading Books

There are a lot of books out there discussing price action trading and technical analysis.

A good deal of them are mind numbingly irksome and are not a huge amount of help.

Troika of the best price carry out trading books from three of the best authors that volition teach you everything from price action patterns to candlestick trading are;

#1: Martin Pring on Price Patterns

Martin Pring on Cost Patterns: The Definitive Manoeuver to Price Pattern Analysis and Interpretation by Martin J. Pring

Martin Pring is nonpareil of the world's most respected traders and trading analysts.

This book is a complete and in-depth look on everything price fulfi patterns. It shows the best patterns, why they work and why others don't.

#2: Encyclopedia of Chart Patterns

Encyclopedia of Graph Patterns by Thomas Bulkowski

In this the back edition of the Encyclopedia of Graph Patterns, Thomas Bulkowski goes finished a huge run of market statistics that are super interesting.

These statistics admit bruiser and bear marketplace statistics, trends, charts patterns and event patterns.

#3: Japanese Candlestick Charting Techniques

Japanese Candle holder Charting Techniques: A Contemporary Pass over to the Ancient Investment funds Techniques of the Far East by Steve Nison

Steve Nison is maybe the most famous price action bargainer of all with two International best selling books.

This is one of the easiest to read and understand books and makes what is a great deal a same complex open relaxed to interpret

Free PDF Guide: Get Your Price Action Trading Guide

Recap

I hope you have been able to mother something out of this price action trading guide.

There is a lot to ascertain when it comes to price action trading and it is not sporty as straightforward as finding one candlestick and then entering trades.

That is also the knockout of price action trading. You tin customize and find a system that suits you and your individual style.

Make a point you prove many different price action strategies to rule what you are most comfortable with and always trial run them first on good free demo charts.

the encyclopedia of trading strategies download

Source: https://learnpriceaction.com/price-action-trading/

Posted by: batespretrusiona47.blogspot.com

0 Response to "the encyclopedia of trading strategies download"

Post a Comment