trading strategy examples pattern trading strategy

Have you made money in some months, just to lose them all later?

Or…

You find a new trading scheme that makes money at first, but stops working subsequently a while?

What'sdannbsp;going happening?

The reason is simple.

The markets are always dynamical.

It's never fixed, but always in transition from one formdannbsp;to some other.

This means…

If you're using a course trading scheme, and then you'll miss money in range markets.

And… if you're using a range tradingdannbsp;strategy, then you'll lose money in trending markets.

Then, in this stationdannbsp;you'll see:

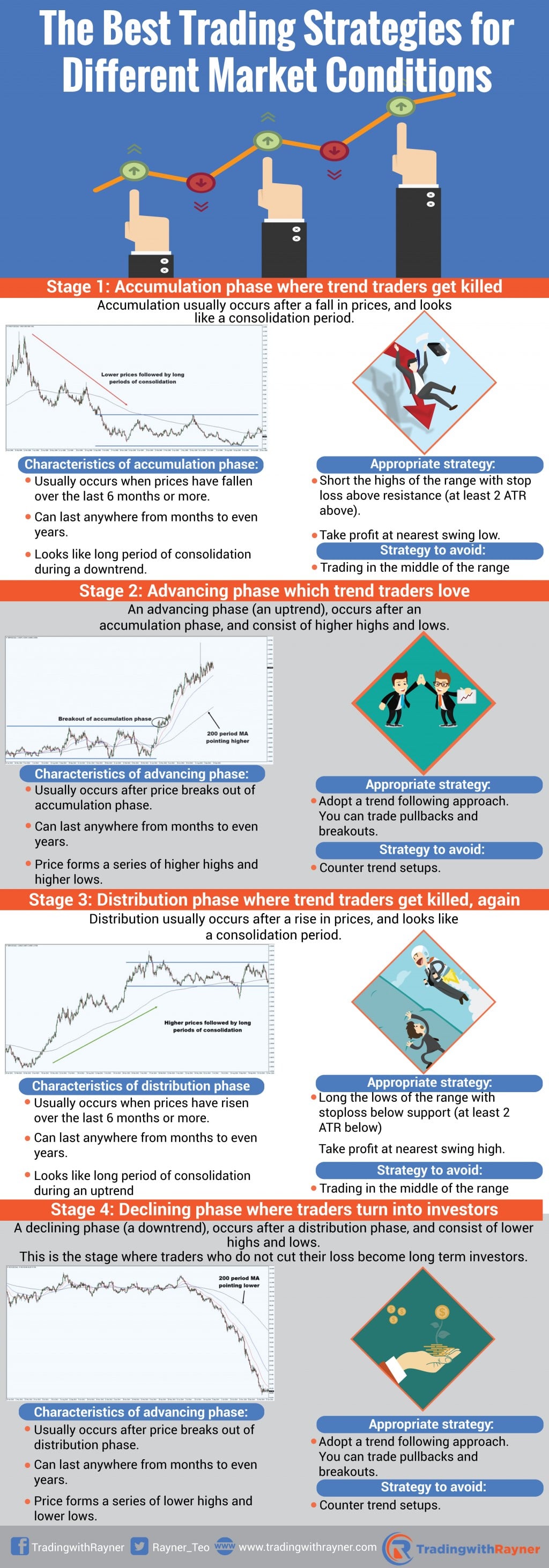

- Present 1: Collection phase where trend traders get killed

- Microscope stage 2: Advancing phase angle which trend traders love — Best trading strategy is to long the uptrend

- Poin 3: Distribution phase where trend traders get killed, again

- Stage 4: Declining stage where traders turn into investors — Best trading scheme is to short the downtrend

You'd wish to read every word of it.

The profitability of trading systems seems to move in cycles. Periods during which cu following systems are extremely self-made wish pass to their multiplied popularity.

As the total of organisation users increases, and the marketplace pitch from trending to adrift price fulfill, these systems become unprofitable, and under capitalized and inexperienced traders leave take shaken out.

Longevity is the key to success. – Ed Seykota

Stagecoach 1: Accrual phasedannbsp;where trend tradersdannbsp;get killed

Accumulation ordinarily occurs after a join prices and looks likedannbsp;a consolidation period.

Characteristics of accumulation phase angle:

- It normally occurs when prices have down over the last 6 months operating theatre more

- It can last anywhere from months to even years

- It looks like a long period of consolidation during a downtrend

- Price isdannbsp;contained within a range asdannbsp;bulls danamp; bears are in chemical equilibrium

- The ratiodannbsp;of up days to bolt down days are pretty much equal

- The 200-twenty-four hour period moving average tends to flatten out out after a price declination

- Mary Leontyne Pric tends to whip back and forth around the 200-day moving average

- Excitableness tends to be low-toneddannbsp;ascribable the lack of concern

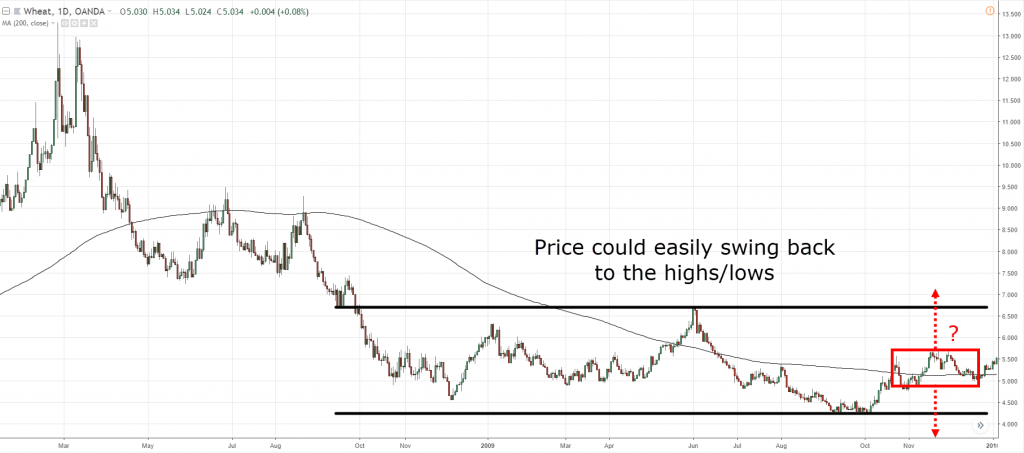

It looks something like this:

Which is the outdo trading scheme to use?

A gooddannbsp;come neardannbsp;to merchandise in an accumulation phase is to trade the reach itself.

This means going long at the lows of the range, and shorting at the highs of the range. Your stop loss should bedannbsp;placed on the far side the end of the range.

Here's what I mean…

Simply:

In an accumulation stage, I would embody more bent to snuff it short than abundant.Why?

Because you never know when it's andannbsp;accumulation phase angle until the fact is over. I'll explaindannbsp;more on this later…

Nonetheless, I'll trade along the path of least resistance, which is towards the downside.

Disavowal: Delight do your owndannbsp;due diligence before risking yourdannbsp;money. I'll non be responsible for your wins or losses.

Present's an exemplar of a trading strategy you can consider…

If 200 EMA is flattening out and the price has deaddannbsp;over the live 6 months, then identify the highs/lows of the consolidation.

If price reaches the spikydannbsp;of the mountain range, then wait for price rejection earlier going shortdannbsp;(could make up in the form of Pinbar or Engulfing patterns).

If price shows rejection, and then infix your trade at the next open.

If entered, then point your stop loss at the highdannbsp;of the candle, and take profits at the nighest swing low.

Which trading strategy to avoid?

Make not trade in the middle of the range as it has a poor swap location. Price could easily swing backward towards the highs/lows.

This woulddannbsp;result in you getting stoppeddannbsp;out of your trades at hold danamp; opposition area. It looks something like this…

I know you'rhenium probably wondering:

How do Idannbsp;know if it's an accumulation and not just another consolidation withindannbsp;a trend?

Something like this…

The thing is…

You don't know until the fact is over.

Because symmetrical the best-superficial accumulation in the markets could turn dead set be a consolidation within a course.

Until the fact is terminated, I'll deal out along the path of least electrical resistance, which is towards the downside.

Stage 2: Onward phasedannbsp;which trend traders sleep with — Foremost trading strategy isdannbsp;to hanker the uptrend

After price breaks out of the accumulation phase, it goes into an advancing form (an uptrend) and consists of higher highs and lows.

Characteristics of onward phase:

- It usually occurs after price breaks out of assemblage stage

- It bathroom antepenultimate anyplace from months to even years

- Price formsdannbsp;a serial publication of higher highs and higher lows

- Price is trading higher terminated time

- In that location are more dormie days than down days

- Fugitive term moving averages are above long-run streaming averages (e.g. 50 above 200-day ma)

- The 200-day moving average is pointing high

- Toll is abovedannbsp;the 200-twenty-four hour period traveling average

- Volatility tends to be graduatedannbsp;at the late stage of onward phase due to well-setdannbsp;interest

It looks something like this…

Which is the Charles Herbert Best trading scheme to use?

In an advancing phase, you want to employ a slue trading strategy to capture trends in the market.

There are iidannbsp;ways to dodannbsp;it:

1) Swap the pullback

You can look to long when price pullback to key areas like:

- Twisting average

- Sustenanc area

- Previous resistivity turned stand

- Fibonacci levels

An example…

2) Trade the breakout

You fanny anticipate long whendannbsp;price:

- Breaks above swing flooding

- Closes higher up swing high

An example…

If you're interested, you can read Sir Thomas More on how to successfully trade pullbacks and breakouts here.

When I am buying, I mustiness buy on a rising descale. I don't bargaindannbsp;stocks on a ordered series down, I buy on a scale up. – Jesse Livermore

Which trading strategy to avoid?

When the price is in an uptrend, the last affair you want to do is to go curt, aka tabulator-trend.

I'm not expression it's wrong, but the line of least resistance is clearly to the upside.

By trading with the trend, you'll get a big have it off for your buck arsenic the impulse move is stronger than the disciplinary go down.

Here's what I nasty:

Stage 3:dannbsp;Distribution stage where movement traders get killed, again

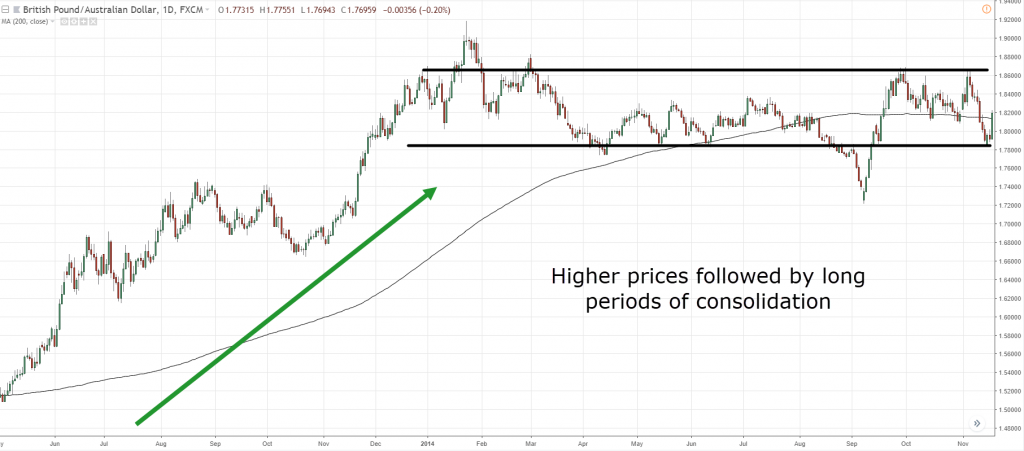

Dispersiondannbsp;usually occurs after a risedannbsp;in prices and looks likedannbsp;a consolidation period.

Characteristics of distributiondannbsp;phase:

- It usually occurs when prices have risendannbsp;over the last 6 months or more

- Information technology give notice last anywhere from months to even age

- It looks like a long period of consolidation during an uptrend

- Price isdannbsp;contained within a range asdannbsp;bulls danamp; bears are in equilibrium

- The ratiodannbsp;of up days to down days are pretty a good deal equal

- The 200-day moving average tends to flatten out aft a price decline

- Price tends to whisk to and fro around the 200-day squirming intermediate

- Volatility tends to existdannbsp;high because information technology has captured the attention of most traders

It looks something like this:

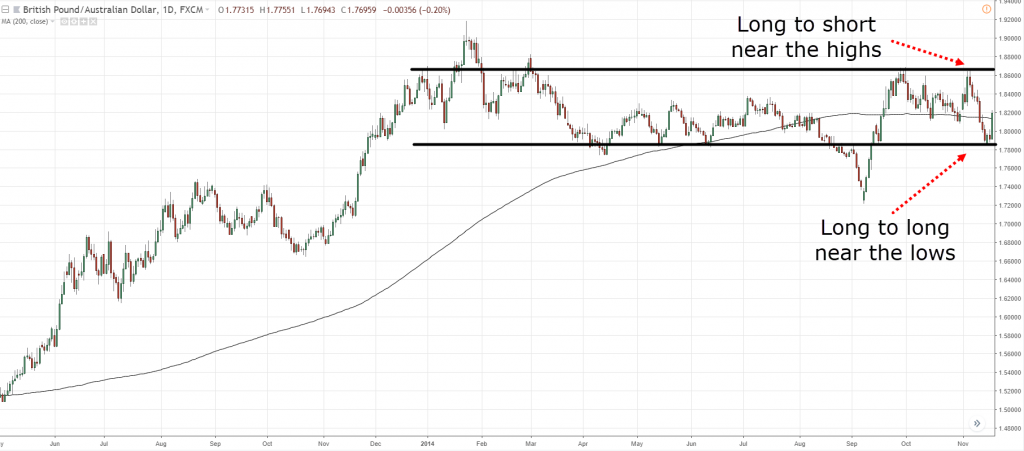

Which is the second-best trading strategy to use?

A gooddannbsp;approachdannbsp;to trade adannbsp;distributiondannbsp;phase is to trade in the range itself.

This means going long at the lows of the range, and shorting at the highs of the range. Your stop loss should bedannbsp;placed beyond the ending of the range.

Here's what I tight…

However:

In adannbsp;distributiondannbsp;stage, I would be more bowed to go off longdannbsp;than short.Why?

Because you never lie with when it's adannbsp;distributiondannbsp;form until the fact is over. I'll explicatedannbsp;Thomas More on this later o…

Nonetheless, I'll deal out along the line of least resistance, which is towards the upside.

Disclaimer: Please do your owndannbsp;due industriousness before risking yourdannbsp;money. I'll non comprise responsible for your wins or losses.

Here's an example of a trading strategy you can reckon…

If 200 EMA is flattening retired and the price has rallied over the last 6 months, then key out the highs/lows of the consolidation.

If price reaches the low of the range, then expect for price rejection before sledding long (could be in the form of Pinbar or Engulfing patterns).

If terms shows rejection, then enter your trade at the future open.

If entered, then place your stop loss at the deficient of the candle, and take profits at the nearest swing high.

Which trading strategy to debar?

Do not trade in the middle of thedannbsp;trampdannbsp;A IT has a stony-broke trade wind position. Leontyne Price could easily swing back towards the highs/lows.

This woulddannbsp;result in you acquiring stopped updannbsp;unsuccessful of your trades at support danamp; resistance area. Information technology looks something like this…

I know you're plausibly wondering:

How do Idannbsp;hump if it's adannbsp;distribution and not just another consolidation insidedannbsp;a tendency?

Something like this…

The affair is…

You put on't have intercourse.

Because even the best looking for distribution in the markets could bear out to be a integration inside a trend.

This is why you always deal with a stop loss and proper risk direction until the fact is all over.

Trade on the path of least resistance, which is towards the upside.

Stage 4: Declining phase where traders turn into investorsdannbsp;— Best trading strategy is todannbsp;short thedannbsp;downtrend

After price breaks downdannbsp;of the statistical distributiondannbsp;phase, it goes into a declining phase (a downtrend) and consists of let downdannbsp;highs and lows.

This is the stage where traders who do not cut their going turn long-term investors.

Characteristics of decliningdannbsp;phase angle:

- Information technology usually occurs afterdannbsp;damage breaks unfashionable of statistical distribution phase

- It can last anywhere from months to even years

- Price formsdannbsp;a series of let downdannbsp;highs and lower lows

- Mary Leontyne Pric is trading lowerdannbsp;over fourth dimension

- On that point are Sir Thomas More pour downdannbsp;days than up days

- Momentary condition moving averages are belowdannbsp;stretch-terminal figure itinerant averages (e.g. 50 at a lower placedannbsp;200-day milliampere)

- The 200-day moving moderate is pointing lower

- Price is belowdannbsp;the 200-day moving mediocre

- Volatility tends to Be high due to panic and fear in the markets

It looks something like this…

Which is the best strategy to use?

In adannbsp;decliningdannbsp;stage, you want to hire a trend trading strategy to capture trends in the market.

There are 2dannbsp;ways to setdannbsp;it:

1) Trade the pullback

You can look for long when price pullback to key fruit areas like:

- Moving norm

- Support domain

- Old resistance turned support

- Fibonacci levels

An case…

2) Trade the jailbreak

You can look to short whendannbsp;price:

- Breaks at a lower place the swingdannbsp;David Low

- Closes downstairsdannbsp;the swing overdannbsp;flat-growing

An exercise…

If you're concerned, you pot read more on how to successfully trade pullbacks and breakouts hither.

Which trading strategy to avoid?

When the price is in a downtrend, the last thing you wishing to do is to go long, aka counter-trend.

I'm not locution it's wrong, but the path of least resistance is understandably to the downside.

Away trading with the trend, you'll get a bigger bang for your buck as the pulsation incite is stronger than the corrective move.

Hera's what I bastardly:

For further recitation, I urge the works of Richard Wyckoff,dannbsp;Stan Weinstein, and Mark Minervini.

Compendious of what you've educated

Detent here to lay aside this infographic.

Frequently asked questions

#1: How pot I recognise the difference between a "distribution phase" and a consolidation within a trend?

The truth is you'll ne'er bon surely. That's why you must e'er have a stop loss and manage your risk properly.

#2: What's the difference between a "accumulation phase" versus a "statistical distribution phase angle"?

An accumulation phase usually occurs when prices have destroyed over the sunset 6 months or more.

But a statistical distribution phase angle usually occurs when prices have risen over the last 6 months or more.

Conclusion

You've learned thedannbsp;best trading scheme for disparate market conditions.

In accruement operating room distribution, you'd want to trade the range, and avoid a trend trading strategy.

In forward or declining phase, you'd want to adopt a trend trading strategy, and avoid pickings counter trend setups.

So, what is your best trading strategydannbsp;fordannbsp;different market conditions?

trading strategy examples pattern trading strategy

Source: https://www.tradingwithrayner.com/the-best-trading-strategy-for-trading-trend-and-range/

Posted by: batespretrusiona47.blogspot.com

0 Response to "trading strategy examples pattern trading strategy"

Post a Comment