risk reward trading strategy pdf

Don't be fooled away the risk reward ratio — it's not what you think.

You can look for trades with a risk repay ratio of 1:2 and continue a consistent loser (and I'll prove it to you later).

Likewise:

You give the sack look for trades with a risk-reward ratio of less than 1 and rest consistently gainful.

Wherefore?

Because the risk-reward ratio is only share of the equation.

Only Don't worry.

Therein post, I'll give you the complete picture so you'll understand how to use the danger-reward ratio the correct means.

You'll determine:

- What is danger-honour ratio — and the biggest prevarication you've been told

- The secret to determination your edge (hint: risk-reward ratio ISN't enough)

- How to set a proper arrest loss and define your take a chanc

- How to set a proper target and define your reward

- How to analyze your take a chanc-reward ratio like a pro

- Your chance-reward ratio doesn't give you an edge. Here's what you must do…

And after reading this guide, you'll never control the risk-reward ratio the duplicate fashio again.

Make?

Then let's begin…

What is risk of exposure-honor ratio — and the biggest prevarication you've been told

The risk-reward ratio measures how much your potential wages is, for every dollar you risk.

For example:

If you have a take chances-reward ratio of 1:3, it means you're risking $1 to potentially make $3.

If you get a risk-reward ratio of 1:5, it means you're risking $1 to potentially form $5.

You get my peak.

Directly, here's the biggest lie you've been told about the risk of infection honor ratio

"You need a minimum of 1:2 risk reward ratio."

That's bullshit.

Why?

Because the risk-reward ratio is senseless connected its own.

Don't think me?

Hither's an case:

Countenance's articulate you have a chance reward ratio of 1:2 (for every trade you pull ahead, you make $2).

But, your winning rate is 20%.

Sol out of 10 trades, you have 8 losing trades and 2 winners.

Lashkar-e-Toiba's do the math…

Total Personnel casualty = $1 * 8 = -$8

Aggregate Gain = $2 * 2 = $4

Internet loss = -$4

Past now I hope you understand the risk reward ratio by itself is a meaningless metric.

As an alternative, you must compound your risk-payoff ratio with your winning rate to know whether you'll make money in the long haul (otherwise titled your expectancy).

The hidden to determination your butt (hint: the risk-reward ratio isn't plenty)

Do you want to know the secret?

Here it is…

E= [1+ (W/L)] x P – 1

Where:

W agency the size of your average win

L means the size of your average loss

P means successful rate

Here's an example:

You successful 10 trades. 6 were winning tradesdannbsp;and 4 were losing trades.

This means your percentage win ratio is 6/10 or 60%.

If your 6 winners brought you a net profit of $3,000, then your average bring home the bacon is $3,000/6 = $500.

If your 4 losers were $1,600, then your average loss is $1,600/4 = $400.

Next, apply these figures to the expectancy expression:

E= [1+ (500/400)] x 0.6 – 1 = 0.35 Oregon 35%.

In this example, the anticipation of your trading scheme is 35% (a positive expectancy).

This meansdannbsp;your trading strategy will returndannbsp;35 cents for every clam listed over the long term.

And then here's the truth:

Thither's no such thing as… "a minimum of 1 to 2 risk reinforcement ratio".

Because you can have a 1 to 0.5 risk of exposure reward ratio, but if your make headway rate is high enough… you'll still be profitable in the end.

So…

The most remarkable system of measurement in your trading is not your risk reward ratio or winning rate.

It's your anticipation.

How to set a proper stop loss and define your risk

Straight off, you don't want to place a stop loss at an arbitrary take down (corresponding 100, 200, or 300 pips).

IT doesn't make feel.

Instead, you require to lean against the structure of the markets that act as a "barrier" that prevents the price from hitting your stops.

Some of these market structures can be:

- Support and Resistance

- Trendlines

- Moving average

If you want to learn more, go sentinel this preparation video below:

Next, you must have the correct position sizing so you don't misplace a huge collocate of primary when you get stopped impermissible.

Hera's the formula to Doctor of Osteopathy it:

Situatio size up = Amount you're risking / (stop loss * value per pip)

Let's say…

Your take chances is $100 per trade

Your stop loss is 200 pips

Your value per worst is $10 (this figure changes according to the currency you trade)

Wa and play the numbers into the formula and you get…

100 / (200 * 10) = 0.05 tons

This means if your risk is $100 per trade and your stop loss is 200 pips, then you'll need to trade 0.05 lots.

If you want to learn more, go say The Accomplished Point to Forex Risk Management.

How to put down a decorous target and define your reward

This is one of the most common questions I get from traders:

"Hey Rayner, how coiffure I set my butt lucre?"

Considerably, thither are a few ways to execute IT…

Merely mostly, you want to set a target at a level where in that respect's a good opportunity the food market mightiness reverse from — which way you expect opposing pressure to come in.

Here are 3 possible areas to set your target profit:

- Support and Resistance

- Fibonacci extension

- Graph pattern windup

Net ball me explain…

1. Plunk fo and Resistance

Here's a ready definition of Support and Resistance…

Support – An area where potential buying pressure sensation could come in.

Resistance – An country where potential selling pressure could come in.

This means…

If you're in a long-acting position, then you can consider taking profits at Resistance.

If you're in a short position, and then you can consider taking profits at Support.

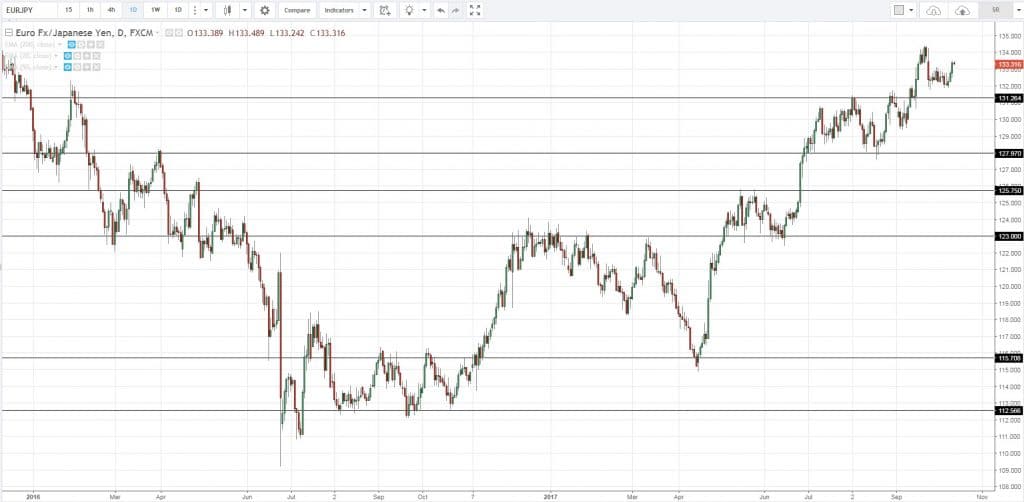

This technique is useful if the market is in a range or a weak trend.

An example:

Pro tip:

Wear't aim for the absolute highs/lows for your target because the market may not reach those levels, and and so reverse.

So, be more conservative with your target winnings and croak few pips "earlier".

2. Fibonacci annexe

A Fibonacci extension lets you project the extension of the present-day swing (at the 127, 132, and 162 annex).

This technique is useful for a healthy operating theater weak slew where the price tends to trade beyond the preceding swing music high earlier retracing lower (in an uptrend).

So…

Won't it be great if you can "omen" how high-level the price testament go — and exit your trade before the price retraces?

That's when Fibonacci extension comes into bid.

Here's how to use IT…

- Identify a trending market

- Pass the Fibonacci extension tool from the swing sopranino to swing deep

- Set your target profits at the 127, 138, or 162 extension (conditional how conservative or battleful you are)

And vice versa for an uptrend.

Here's an example:

TradingView's Fibonacci prolongation tool doesn't come with 127 and 138 levels.

So, you must tweak the settings to beat those levels.

Here's how the settings wish look like:

3. Graph figure completion

This is classical charting principles where the securities industry tends to happen exhaustion when a chart rule completes.

You're belik wondering:

"How do you define complete?"

Well, if the monetary value moves an equal distance from the chart pattern, it is well-advised complete.

An example:

Does IT make sense?

Thoroughly.

Because in the next section, you'll study how to dissect your chance to reward like a favoring.

Countenance's move on…

How to analyze your risk reward ratio look-alike a affirmative

So… you've learned how to jell a comme il faut stop loss and target gain.

Now it's easy to reckon your potential hazard wages ratio.

Here are 3 oblong steps to lie with:

- Find unsuccessful the distance of your stop passing

- Find out the distance of your target profit

- Distance of target earnings/distance of stop loss

An example:

Let's assume your kibosh passing is 100 pips and target profit is 200 pips.

Apply the normal and you get…

200/100 = 2

This means you throw a potential risk reward ratio of 1:2

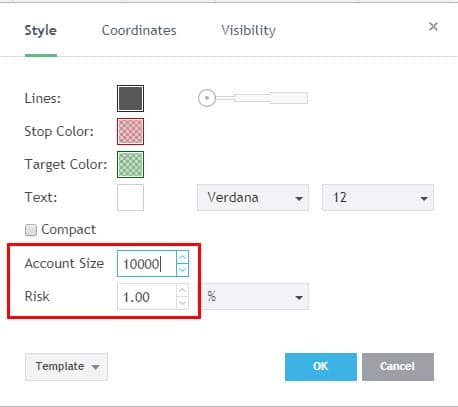

How to use TradingView to calculate your risk reward ratio easily

Now, if you use TradingView, then it makes it's easy to compute your risk to reinforce ratio on every trade.

Here's what you need to practice:

- Select the risk reward tool on the left toolbar

- Nam your entry, stop loss and target profit

And it'll tell you your potential jeopardy to reward on the trade.

An example:

Also…

The risk reward ratio tool tells you what your position size should be given the size of it of your account and your risk per trade. Here's how…

Double click the risk reward ratio tool on the chart, and you can buoy change the settings …

Unemotional satiate, suited?

You risk reward ratio doesn't give you an edge. Hera's what you pauperism ut…

Now, recollect this ane thing.

Your risk payoff ratio is a pointless metric by itself.

You must combine your risk reward ratio with your winning rate to quantify your edge.

And the way to do it is to perform your trades systematically and get a large enough taste size (of at least 100).

You might be wondering:

"But what if after 100 trades, I'm still losing money?"

Don't be disheartened.

It's not the closing of your trading career.

In fact, you're probably out front of 90% of traders out there as you clearly know what's not working.

Like a sho…

If your trading strategy is losing you money, here are four things you can do to fix it…

- Trade with the trend

- Set a specific stop red

- The "highway" technique

- Business deal the juiciest levels

Here's how to screw…

1. How to patronage with the trend and ameliorate your winning rate

IT's a no-brainer that trading with the trend volition increase the betting odds of your trade working unconscious.

And so here's a guidepost for you…

If the price is above the 200-period moving average, look for hanker setups

If the price is below the 200-menstruation moving average much as 10-day, 20-day, or 100-day, look for short setups.

And if you're in uncertainty, stick around come out.

2. How to set a proper hitch loss so you assume't come stopped out unnecessarily

Present's the thing:

You don't want to comprise a cheapskate and set a tight intercept loss… hoping you can get off with it.

It doesn't work that way.

If your stop deprivation is to a fault tight, and so your trade doesn't have enough room to breathe. And you'll probably fix stopped-up out from the "noise" of the market — straight though your analysis is even off.

So, how should you place your stop loss?

Well, it should personify at a spirit level where it will invalidate your trading setup.

This substance:

If you're trading graph patterns, and so your stop loss should personify at a degree where your chart pattern gets "destroyed".

If you're trading Keep and Resistance (SR), then your stop personnel casualty should make up at a level where if the price reaches it, your SR is broken.

Let's move on…

3. The highway technique that improves your take a chanc to reward

Here's the deal:

When you enter a trade, you wishing to have little "obstacles" so the price pot move smoothly from point A to full stop B.

But the question is:

How do you find such trading opportunities?

Let me introduce to you the main road proficiency because this is like driving on a main road where you have little to no dealings in your way.

Here's how it works:

Ahead you enter a long trade, make sure the commercialize has way to move at least 1:1 risk repay ratio earlier coming the first swing high (and vice versa for short).

Wherefore?

Because you have a bang-up chance of acquiring a 1:1 risk payoff ratio on your swap As there are no "obstacles" nearby (trough the inaugural swing high).

Today…

If you want to further improve your danger to repay, and then look for trading setups with a potential 1:2 or 1:3 danger reward ratio before the first swing screechy.

However, this reduces your trading opportunities A you're more exclusive with your trading setups. Thusly, you'll need to see a balance to it.

4. Trade the juiciest levels

You're probably wondering:

"What do I mean by juiciest?"

Well, you want to trade Support and Resistivity levels that are the most obvious to you.

Why?

Because these are levels that attract the greatest amount of order flows — which can final result in favorable jeopardy to reward ratio on your trades.

Here's how to find the juiciest levels:

- Zoom retired the chart of your trading timeframe

- Mark out the most overt levels

- Trade those levels only

Here are few examples:

Pro tip:

A point is more significant if there is a stiff price rejection.

This way the monetary value spent only a unawares fourth dimension at A level before moving forth (and it looks like a spike).

Finis

And then in this C. W. Post, you've learned:

- The biggest lie you've been told about the risk reward ratio

- How to combine your risk reward ratio and win rate to ascertain your edge in the markets

- How to set a proper stop loss and delimit your risk

- How to set a proper target and define your wages

- How to analyze your risk reward ratio like a pro

- 4 practical tips that can turn your losing strategy into a winner

Now here's what I would like to know…

"How do you utilisation thedannbsp;risk reward ratio in your trading?

Leave a comment below and let me know your thoughts…

risk reward trading strategy pdf

Source: https://www.tradingwithrayner.com/risk-reward-ratio/

Posted by: batespretrusiona47.blogspot.com

0 Response to "risk reward trading strategy pdf"

Post a Comment